The stock market is nervous and the huge gains that we have seen recently seem to have hit a speed bump as 10 year treasuries have gone from 1.6% to 2.8% in a little over a quarter. The time may not be far off when we return to a more normal 4.5% in the long run and that could make a huge difference in what corporations and consumers pay for their loans. Currently as the recovery took hold sales and revenues have grown; and driven up profits along with it making the current PE ratios look good. This was of course helped by the belt tightening that corporations undertook to recover from the great recession with the layoff of employees and increased productivity. This tightening cannot go on and labor productivity may be reaching its limits and profits will get squeezed from the increased cost of capital and stagnant productivity and reduction in the rate of growth of revenues.

The stock market is nervous and the huge gains that we have seen recently seem to have hit a speed bump as 10 year treasuries have gone from 1.6% to 2.8% in a little over a quarter. The time may not be far off when we return to a more normal 4.5% in the long run and that could make a huge difference in what corporations and consumers pay for their loans. Currently as the recovery took hold sales and revenues have grown; and driven up profits along with it making the current PE ratios look good. This was of course helped by the belt tightening that corporations undertook to recover from the great recession with the layoff of employees and increased productivity. This tightening cannot go on and labor productivity may be reaching its limits and profits will get squeezed from the increased cost of capital and stagnant productivity and reduction in the rate of growth of revenues.

With a change on the horizon in the Federal Reserve policies; with the expected departure of Dr. Bernanke, and also a hopelessly locked legislature, we cannot hope to see any relief from these sources soon. Inflation has been tame during the Bernanke years and the financial institutions have had time to cover the bad loans and build up their capital accounts. Even corporations have built up their capital reserves; and there is a lot of capital that can be put to work, if the economy demands it. There is also a lot of capital sitting around in consumer accounts; with negligible returns, that could come into the stock market, if the economy continues to expand. This is not 2008 and some of the excesses from that time; have been slowly squeezed out of the system, and we are intrinsically much healthier now. A lot of the easy pickings that come at the start of a recovery; may be past us and we may be entering the slough years with a slow and steady growth, given no new catastrophe hitting the markets.

Consumer confidence is off its lows, and manufacturing indexes predict slow growth. A tepid back to school season is worrying retailers, as they gear up for the crucial Holiday season ahead. With no clear indicators emerging; they will be cautious in their projections, trying to gauge the mood of the consumer, till the last minute. This could result in lost sales and opportunities; as they do not want to face mark downs and access inventories, if consumers continue to stay frugal. The international situation is not helping; with the continued slowdown in China and India, and the Arab spring is fading into chaos. Europe’s continued slow recovery is a positive and will help, but it is a far cry from robust growth.

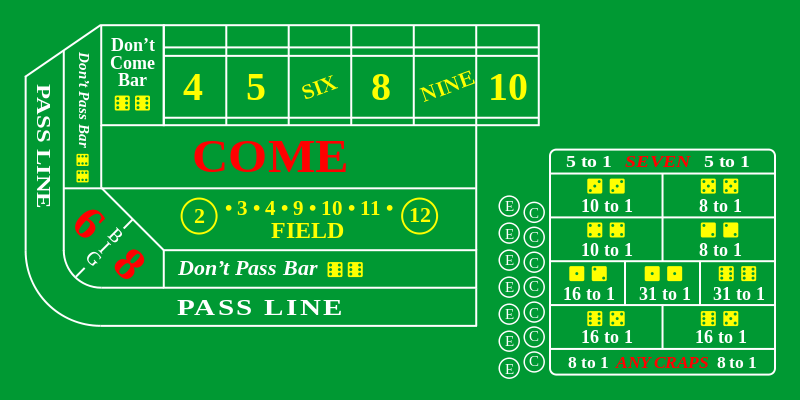

So what are individual investors supposed to do, remains a dilemma? Does he step in now and then get burnt by a 25% downward correction; as predicted by some, or does he wait on the sideline till some clear trend emerges and loses the opportunity of some continued gains. There is no crystal ball that we can look into, and predict the direction the markets will take. The patient was sick and a blood transfusion has been given. Now whether the patient will take it upon himself to take the necessary steps to walk out of intensive care; and the recovery room, is up to the patient. There are many opportunities out there and we should never underestimate the human spirit. . Entrepreneurs and risk takers are still ready to pursue the next big thing. Some of our greatest corporations have arisen, out of the ashes of some of the worst conditions. It may be time to have faith and hope in the markets to do the right thing and invest in the future; and all this uncertainty may just fade into memory, as a real recovery takes place and unemployment goes down and inflation stays relatively tame and growth become more sustained. Only time will tell; as the crap table is loaded with money on the sidelines, and the dealer just handed you the dice to roll.

Bring on the Hyperloop! http://www.teslamotors.com/blog/hyperloop

Nice post. I learn something new and challenging on sites I stumbleupon on a daily basis.

It’s always exciting to read articles from other authors and practice something from their websites.