India’s falling stock markets, rupee valuations and rising inflation are now spreading to South East Asia also. The Indian Stock Market is swooning and the rupee is in a free-fall; as global investors pull out cash, to invest in more developed economies; fearing the withdrawal of the U S stimulus policies. Indonesia’s market is the worst performer among the global indexes; as it has lost 8% in the last two days, and 10% since the start of July. Thailand once considered an Asian tiger is now officially in recession; with two quarters of declining GDP, as it is affected by China’s slowdown.

As a young MBA student in the US I had found little research on the Indian economy; and was delighted to find Gunnar Myrdal’s study as he had in 1974, received the Nobel Memorial Prize in Economic Sciences with Friedrich Hayek for “their pioneering work in the theory of money and economic fluctuations and for their penetrating analysis of the interdependence of economic, social and institutional phenomena.” After reading his work on India I came away puzzled by his description that because India is a “Soft State,” development had languished and would continue to languish, for the foreseeable future. I never really understood what it meant at that time; as I had not experienced the checks and balances and disciplined systems, developed in the western economies. All I knew was that things just worked when you switched on the light, turned on the tap, caught a plane, train or bus as they were on time; as opposed to what I had experienced back at home. Having spent countless hours in foul smelling train stations where people heaped their whole house hold into the compartments that were stuffy beyond measure in sweltering heat; the air conditioned\heated splendor of comfortable travel was pleasant, and readily accepted as the new normal.

It was not till many decades later during the current reign of Sonia’s congress and Dr. Manmohan Singh’s second term that the meaning of the soft state has become stark and clear. It is a state that cannot take decisions and act to protect its own institutions. Truth needs to be armed and given the weapons to defend itself. It should not be a timid whisper spoken apologetically from the ramparts of the red fort; but thundered and enforced by the legislative and judicial bodies. The third rail of the administration its IAS and PCS cadre; should be held to higher standards, and allowed to do their job. Labor reform, land reform, equal justice for all communities, education reform, and infrastructure development should be the focus and not an afterthought of political gains. The pandering to selective vote banks; ensures that power is maintained, at a cost to the growth of the economy and the general good suffers, and morale and commitment of good hard working honest men is looked down upon. To be successful is not looked up to or emulated; as it is understood to mean that one is either corrupt, politically connected or at worse a thug and a cheat.

I read recently the recommendations of a leading body “Looking ahead,” the BBVA team wrote, “bolder structural reforms, including greater fuel price liberalization, land acquisition reforms, and higher foreign investment limits in insurance, pension management and the pharmaceuticals industry are crucial to regain investor confidence and shore up the rupee.” I almost laughed to myself remembering the soft state argument; I had read so many years ago, and wondered who could possibly implement a fraction of the medicine that is being recommended. I am not saying that there are not brilliant and dedicated leaders in India, as otherwise the society would fall apart, I am just saying that the power is in the wrong hands. The state has gone into the hands of leaders in India and Thailand for example who have accumulated mountains of rice in their Government storage, while the poor starve outside. The political economy of the state has corroded to the point, where common sense and law are byproducts and goals are set for the wrong outcomes. The state gathers economic power into its institutions; and disbars its own citizens from taking the right economic actions, to better themselves and pursue their happiness.

The road ahead is murky and fraught with danger as continued fiscal deficits and unfinished projects and unproductive state enterprises will continue to eat away the countries valuable reserves. There is no bold leader here who can persuade the legislative body and administration into taking the right action. We deserve the leaders we appoint in a democracy, as the public is neither gullible nor foolish. They have just become used to living in a soft state; and accept the latest scandal and shenanigans with a shrug of their shoulders, as this is how life has always been. There will be no Arab Spring or revolution here, as the people are too preoccupied with the price of onions and finding a decent place to live. They do however expect miracles to transform their life; as that of course is the essence of the soft state, where expectations run high and actions run low. It is a beautiful but poignant tale like the full moon rising tonight; which reflects the brilliance of the sun, but has no power on its own.

Category Archives: Nature

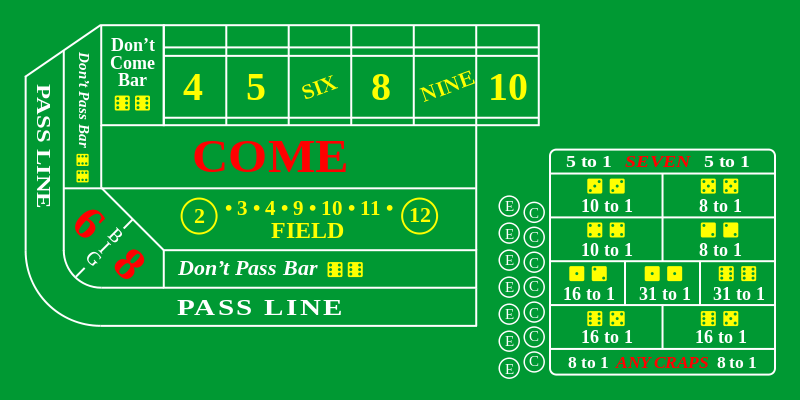

Crap shoot

The stock market is nervous and the huge gains that we have seen recently seem to have hit a speed bump as 10 year treasuries have gone from 1.6% to 2.8% in a little over a quarter. The time may not be far off when we return to a more normal 4.5% in the long run and that could make a huge difference in what corporations and consumers pay for their loans. Currently as the recovery took hold sales and revenues have grown; and driven up profits along with it making the current PE ratios look good. This was of course helped by the belt tightening that corporations undertook to recover from the great recession with the layoff of employees and increased productivity. This tightening cannot go on and labor productivity may be reaching its limits and profits will get squeezed from the increased cost of capital and stagnant productivity and reduction in the rate of growth of revenues.

The stock market is nervous and the huge gains that we have seen recently seem to have hit a speed bump as 10 year treasuries have gone from 1.6% to 2.8% in a little over a quarter. The time may not be far off when we return to a more normal 4.5% in the long run and that could make a huge difference in what corporations and consumers pay for their loans. Currently as the recovery took hold sales and revenues have grown; and driven up profits along with it making the current PE ratios look good. This was of course helped by the belt tightening that corporations undertook to recover from the great recession with the layoff of employees and increased productivity. This tightening cannot go on and labor productivity may be reaching its limits and profits will get squeezed from the increased cost of capital and stagnant productivity and reduction in the rate of growth of revenues.

With a change on the horizon in the Federal Reserve policies; with the expected departure of Dr. Bernanke, and also a hopelessly locked legislature, we cannot hope to see any relief from these sources soon. Inflation has been tame during the Bernanke years and the financial institutions have had time to cover the bad loans and build up their capital accounts. Even corporations have built up their capital reserves; and there is a lot of capital that can be put to work, if the economy demands it. There is also a lot of capital sitting around in consumer accounts; with negligible returns, that could come into the stock market, if the economy continues to expand. This is not 2008 and some of the excesses from that time; have been slowly squeezed out of the system, and we are intrinsically much healthier now. A lot of the easy pickings that come at the start of a recovery; may be past us and we may be entering the slough years with a slow and steady growth, given no new catastrophe hitting the markets.

Consumer confidence is off its lows, and manufacturing indexes predict slow growth. A tepid back to school season is worrying retailers, as they gear up for the crucial Holiday season ahead. With no clear indicators emerging; they will be cautious in their projections, trying to gauge the mood of the consumer, till the last minute. This could result in lost sales and opportunities; as they do not want to face mark downs and access inventories, if consumers continue to stay frugal. The international situation is not helping; with the continued slowdown in China and India, and the Arab spring is fading into chaos. Europe’s continued slow recovery is a positive and will help, but it is a far cry from robust growth.

So what are individual investors supposed to do, remains a dilemma? Does he step in now and then get burnt by a 25% downward correction; as predicted by some, or does he wait on the sideline till some clear trend emerges and loses the opportunity of some continued gains. There is no crystal ball that we can look into, and predict the direction the markets will take. The patient was sick and a blood transfusion has been given. Now whether the patient will take it upon himself to take the necessary steps to walk out of intensive care; and the recovery room, is up to the patient. There are many opportunities out there and we should never underestimate the human spirit. . Entrepreneurs and risk takers are still ready to pursue the next big thing. Some of our greatest corporations have arisen, out of the ashes of some of the worst conditions. It may be time to have faith and hope in the markets to do the right thing and invest in the future; and all this uncertainty may just fade into memory, as a real recovery takes place and unemployment goes down and inflation stays relatively tame and growth become more sustained. Only time will tell; as the crap table is loaded with money on the sidelines, and the dealer just handed you the dice to roll.

Earth’s warning

A report by the United Nations Environment Program and the World Meteorological Organization in 2011 said: “They (soot and urban smog pollution) disturb tropical rainfall and regional circulation patterns such as the Asian monsoon, affecting the livelihoods of millions of people.” A neighbor’s father visiting from Seoul was complaining bitterly the other day; of the soot and acid rain and pollution raining down on them from the giant coal burning plants in neighboring China, destroying their air quality. Increasing urbanization and populations needs massive amounts of energy, and we have to make some hard choices on how renewable forms can be increased with minimal pollution. This year an unusual pattern of the monsoon advancing towards the west of South Asia; confronted strong westerly winds for an unusually long time and with an extraordinary intensity, which resulted in days of torrential rains. The westerly and monsoons do not normally coexist and the war between such massive weather systems ;brought devastating floods as currently faced, in India’s Uttarakhand state, Nepal and areas of Pakistan.

Variations in monsoon precipitation are predicted for the coming decades; and while no one points to global warming, the amount of rain and snow that falls will become more difficult to predict reliably. We see similar random events happening all over the world; as seen in the torrential cloud bursts and downpours in Canada, China and we can look at the ominous black dots spreading across the USGS flood mapping system, for more proof. Black means the high flood levels that streams and rivers have reached in the current records. The realists will say that this is the weather, and there is no way to predict how the massive Eco-systems of the Earth will behave. The long droughts in once green lands of Africa, Nevada and Australia are just symptoms of an earth deciding what to do, with its human provided power, and she is sending us subtle signals like a good mother. Warming oceans have a belligerence; we do not want to experience, as they unleash typhoons, cyclones, hurricanes and tornadoes rushing down on hapless populations. A majority of these storms rise and fall in the seas and we do not experience them first hand; and only occasionally when they make land fall, do we seek shelter in awe and pray for them to pass with minimal damage to life and property. While the global warming will aid the growth of crops and fauna when the weather gods are kind; it will be when in their fury they unleash their awesome power, that we will come to know the Pandora’s Box we have opened.

There is still time to reverse some of this; but it will take years of dedicated effort as a yearning multitude has to be fed, housed and cared for at the same time. The earth is gracious and kind to allow us to exist and grow on it, but it is also our responsibility as its children, to take care of our mother or else she may turn on us, and make us homeless. We live in this garden of earthly delights, and our decisions and actions today will decide whether our future generations will continue to live in this paradise, or the mother banishes them to burn in hell. Unfortunately the rich conservatives are busy fighting the wrong wars, and leading us down the wrong path. We have the technology and can come up with innovative ways to solve our problems, but the allocations of resources are controlled by the few, who remain clueless to our progeny’s plight.